Importance of Finance Management | How not knowing financial management makes you Rookie !

Henry David Thoreau said " Wealth is the ability to fully experience life"

If you own a business the finance management is the lifeblood of your organization.

You need excellent knowledge in finance management to run smoothly and successful business or you can hire a finance manager.

To make your business growth, you need several resources of income and you also need to allocate risks, divide the right amount of dividends among investors and etc

Which is not possible without financial management.

Read on and find out about finance management, make your business successful.

What is Finance Management?

Finance Management means Planning, Organizing, Monitoring, and Controlling various financial resources to maintain the supply of funds for business or organization.

Finance Management plays a huge role in providing funds needed by businesses or organizations.

These funds are the necessity of any Business or Organization.

Finance Management helps to maximize the value of Business or Organization.

But Managing finance involves many stakeholders like Creditors, Owners, Stockholders, and many other members/participants of the financial market.

Finance management also ensures that stakeholders of business or organization are getting great returns on their investments.

Main Objectives of Finance Management

1) Profit Maximization

Profit Maximization is the process in which firms determine the price, input, or output levels which leads to the highest profit.

Profit Maximization can be short term or long term process.

In simple words profit maximization is the process, the company uses to determine the best output and price level to achieve the goal.

Profit maximization is the main reason company or business heir finance manager is to maximize profits while managing the finance of the company/business.

Profit ensures the survival and growth of business or company.

Now how to calculate profit maximization?

Profit Maximization have a simple formula which is,

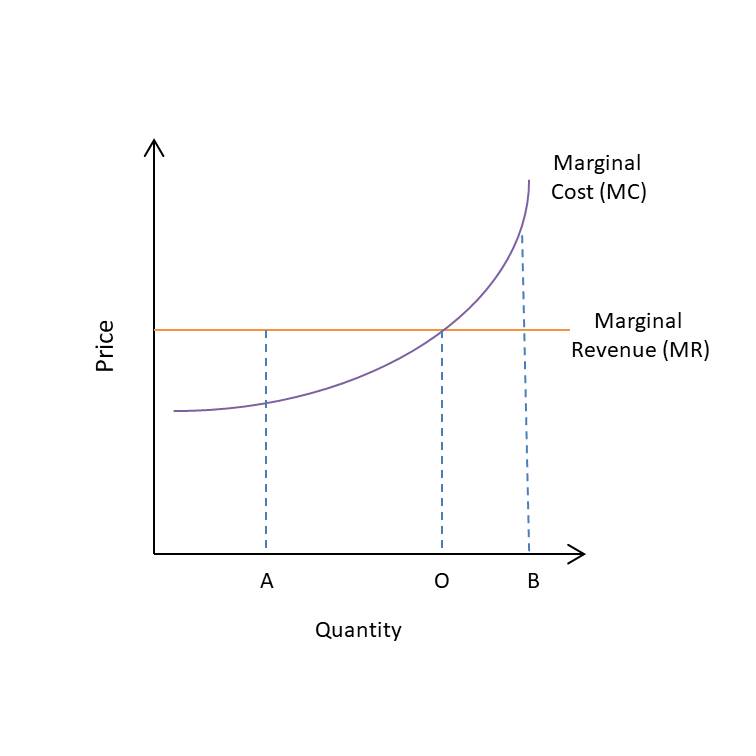

MC=MR

Whereas,

MC stands for Marginal Cost, it is increased cost by producing more input of goods.

MR stands for Marginal Revenue, it is the change in total revenue as a result of changing the rate of sales by time.

Now as of the above fig,

At point A, we can see MC < MR. Which means every additional unit production, revenue will be higher than cost.

And at point B, we can see that MC > MR. which means every extra unit production the cost will be higher than revenue.

2) Wealth Maximization

The main goal of Wealth Maximization is to maximize the wealth of shareholders of the company or business.

Wealth Maximization is also known as Net Worth Maximization.

Shareholder wealth will increase as the market value of the company or business increases.

The Wealth Maximization is based on the cash flow of Business. It is not based on profits earned by the business.

Time Value of money is considered in Wealth Maximization.

Usually, there is a team in a company or business which manages and searches the highest ways of returns on funds/shares invested in the business.

Meanwhile, it manages and mitigates the risk of loss.

3) Maintaining Proper Cash Flow

Cash flow is one of the important aspects of financial management.

Cash flow is the process of funds in & out of your business.

Cash flow management team analysis this either weekly, monthly, or quarterly.

There are basically two types of Cash Flows :

a) Positive Cash Flow: It is when cash set foot in your business from sales, account receivables, etc is more than the amount of cash is leaving your business through salary, expenses or etc.

b) Negative Cash Flow: It is when Cash outflow is greater than the incoming cash. This generally indicates trouble sign for a business.

4) Capital Cost Reduction

The capital structure is planned in such a way that capital cost gets minimized.

Finance Management team reduces the cost of capital by borrowing money at a low rate of interest.

5) Survival of Company

It is the most important aspect of Financial Management.

The survival of the Company is most prioritized when the financial manager makes any financial decision.

One bad decision can cause bankruptcy to business or company

Though the financial manager should be careful when it makes any financial decision.

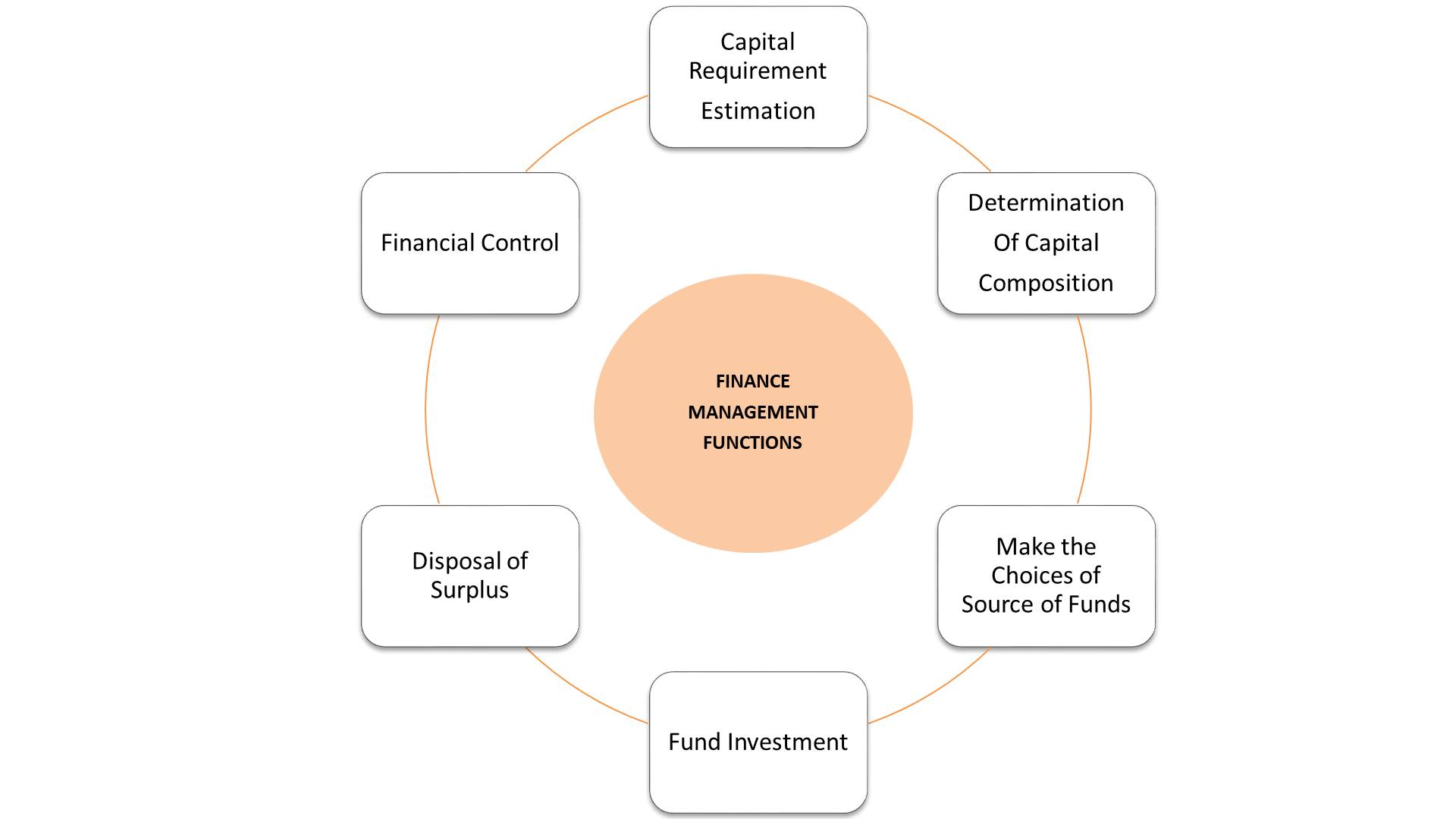

Main functions of Finance Management

1) Capital Requirement Estimation

In simple words, the finance manager has to make an estimation with the overall Capital requirement of the company.

This will depend on several aspects like expected profits, policies of the company, probable cost, etc.

As to increase the capacity of the business, the finance manager makes predictions in concern and an adequate manner.

The finance manager also decides whether the process will be for the short term or long term.

2) Determination of Capital Composition

Debt and equity are the financial terms of Capital Composition or Capital Structure.

In which equity is the amount of money in which shareholders invest in a firm or business.

Now Capital structures are involved in two decision :

1) Securities to be issued are equity shares, preference share or long term borrowing(Debentures)

2) Relative Ratio of securities which process capital gearing.

It is future classified into two types in which a company divides in:

a) Highly Geared Company: The company which is highly geared, if a large portion of capital is structured in fixed interest or dividend-bearing funds.

b) Low Geared Company: When a large portion of capital is structured of common stockholder's equity.

3) Make the Choices of Source of Funds

Equity, debentures, capital loans, term loans, debts, retained earning, venture funding, etc is the sources of finance for firm/business.

Choosing the right source and leveraging finance is a key challenge for every finance manager.

So sources of finance can be classified based on the period like the long term, the middle term, the short term, etc.

-In which long term period involves equity shares, retained shares, debentures, etc.

-The Middle term involves bank loans, loans from financial institutions, and public deposits.

-The short term includes Factoring, loans, commercial paper or etc.

Sources of finance are also classified based on Ownership.

-Owner funds which include equity shares & retained earning.

-Borrowed funds which include debentures, financial institution loans, bank loans, lease, or etc.

Financial Sources are also classified based on generation in which there are two types:

- Internal Sources, which includes equity share capital & retained earning.

- External Sources, which includes a financial institution, bank loans, debentures, trade credit, factoring and etc

4) Fund Investment

In simple words, fund investment or investment fund is the way to invest money.

Example: There are thousands of individuals who invest their money to buy stocks, bonds, real estate or etc.

Every country has its own terminology to buy stocks or bonds, but investment funds are often called as an Investment pool, managed funds, simply funds or etc.

There are two main types of investment fund which are:

1) Open-Ended: Open-ended funds are very famous among investors.

The majority of investment funds belong in open-ended Fund types.

Hedge funds, Exchange-traded funds, etc are included in this type.

2) Closed-Ended: Closed-ended funds are similar to stocks.

They are managed investments with a fixed number of shares and trade on an exchange.

In this, NAV (Net Asset Value ) for funds is calculated. The fund is tread based on the supply and demand of investors.

5) Disposal of Surplus

In the Disposal of surplus, the decision is to make in two ways.

1) The finance manager decides how much dividend to distribute to shareholders out of the profits.

2) How much to reinvest in the company to make the company grow.

These factors are usually decided based on earning of the company.

6) Financial Control

Financial Planning, disposal of surplus, fund investment, are not the only function, finance manager have to control.

Various types of analysis, forecasting profit distribution, cost analysis, and etc finance manager have to take care of.

All techniques are essential parts of finance planning, which finance managers must emphasize.

Some of the Major Roles in Finance Management.

1) Financial Planning

Finance planning contains a document of the current money situation of business, firm, or individual.

In simple words, financial planning is planning of your future, which helps to achieve your dreams and goals financially.

It also contains goals on long term or short term basis and strategies to achieve them.

Financial Planning helps to control, analyses your expenses, investment, income or etc to achieve the goal.

2) Financial Decision & Controlling

Finance Controlling, basically it is the analysis of companies' financial plans.

It approaches in a different perspective, time, or even in period i.e. long term, short term, or medium term.

Finance Decision, In simple words, the finance managers have to make decisions related to financial investment, working capital, or dividends.

As these decisions are a key aspect of business or firm, so finance manager have to make the right decision.

3) Investments

It is the process of investing money for profits.

Investment can be in different form like equity, assets, buying land, gold, bonds, or anything which not consumes today but are used in the future to create wealth.

The benefit which you get from owe investment is called returns.

But one can not always use for profit, as an investment also involves some degree of risks.

Risk involves some or everything to lose.

But there are many firms, finance managers are there which can help you manage risks.

4) Capital Management

It is the management or strategy to maintain a sufficient equal level of capital, current assets, and current liability.

Capital management maintains a proper balance between liquidity, growth & profitability.

The working capital indicates the difference between debt, current assets, and current liability.

This also helps to plot graphs on how the company is operating and how financially stable the company is in the short term.

5) Financial Reporting

It covers all the financial results, the information relates management, stakeholder & companies performing all over a period of time.

Financial Report helps people outside of the company to know the financial health of the company.

It basically provides companies financial performance and position over a period of time by which investors, creditor and such other can know company health financially.

The financial report includes :

The financial statement which includes a balance sheet, cash flow statement, change of stockholders equity, profit & loss account.

If a company is listed in the market, quarterly & annual reports are provided by the company.

And if the company is going for IPO's, Prospectus reports are provided by the company.

Conclusion

How not knowing Finacial management makes you ROOKIE!

Finance management is a step by step approach to meet firm, business, or even an individual's goals.

Finance management allows you to control your expenses, income, investments such that you can manage your money.

Finance management increases your saving and allows you to have insight into where, how, how much money is getting used.

Finance management prepares you for upcoming emergencies.

It not only helps individuals but also firms or businesses. It allows you space in which you can easily invest without any risks of bankruptcy.

If your business is not growing for decades! Probably the reason is finance management.

You are not buying assets that can help you grow your business.

Try to hire a finance manager or in case if you can't hire one, there are many consultant firms are available.

These firms will help you achieve your goals or dreams even if you only have only 100 dollars in your pocket.

Comment Down bellow What do you think about Financial Management?

Till Then Stay Safe & share this article to your loved once, let them know how finance management can change a life.

Sharing is Caring.

0 comments:

Post a Comment